nj tax sale certificate premium

545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate. 545-113 Private sale of certificate of tax sale by municipality.

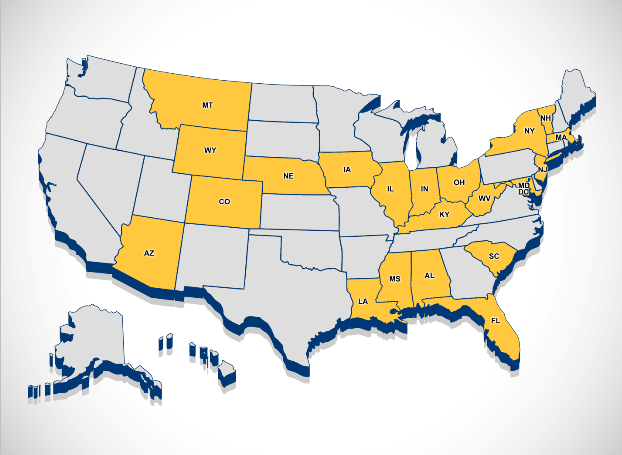

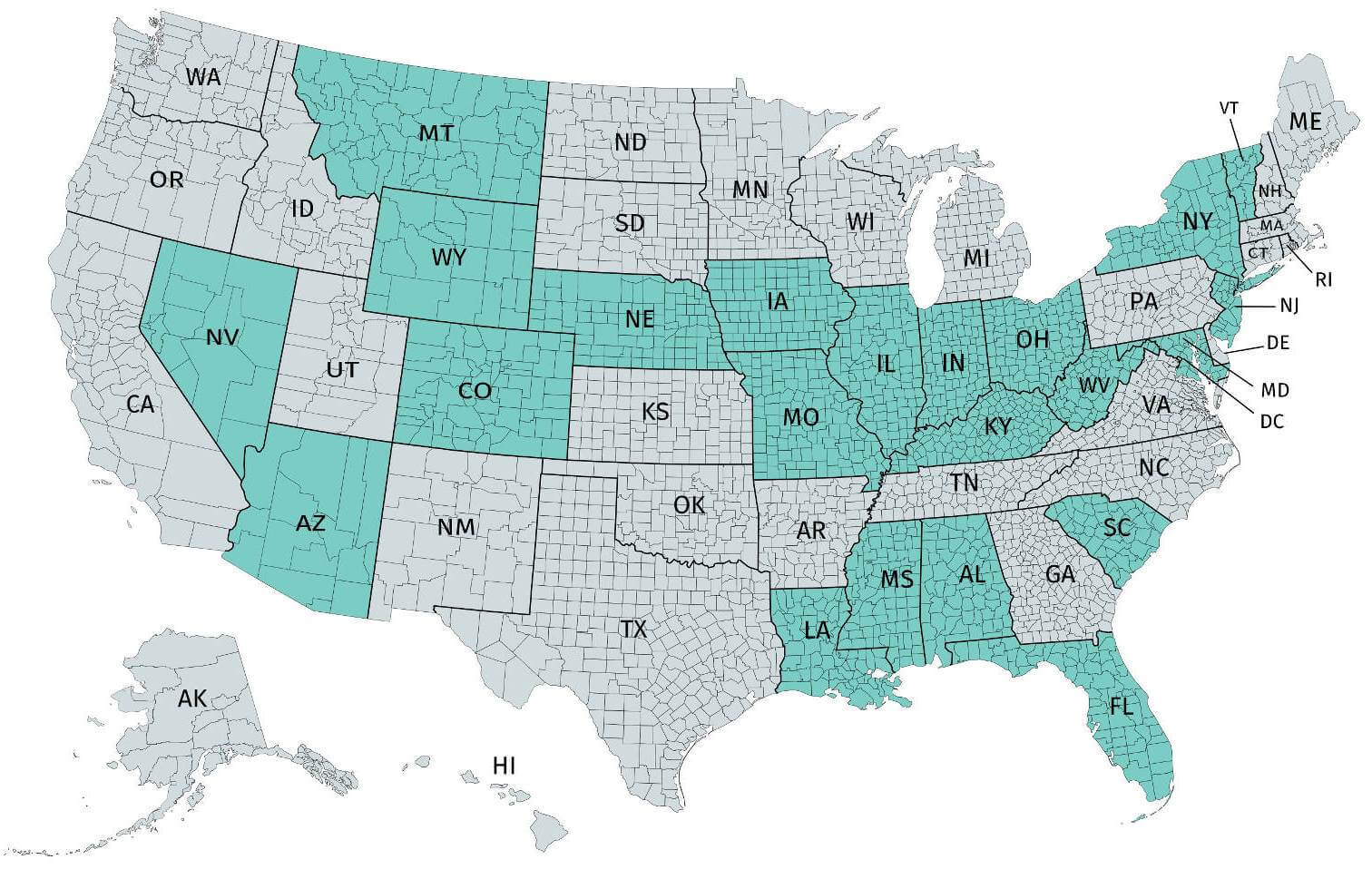

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate.

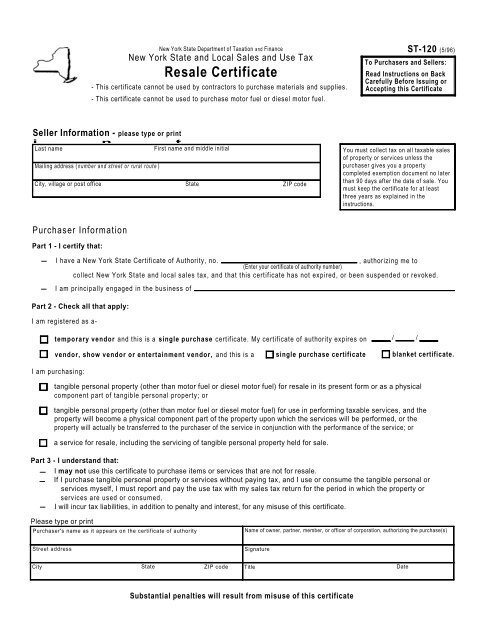

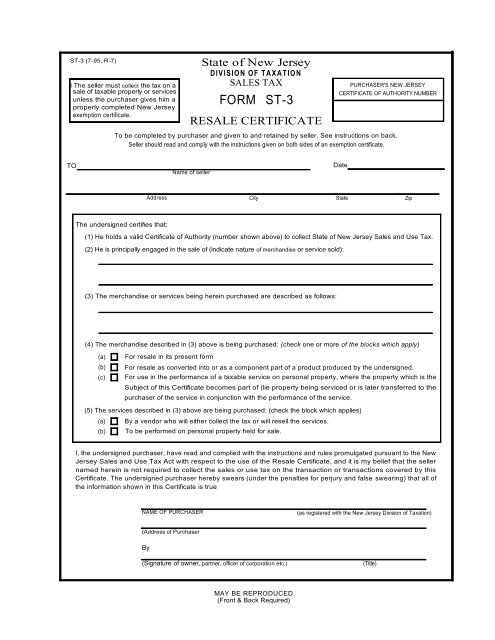

. Some municipalities include an additional 6 year end penalty on tax lien certificates. The premium is returned to the investor should the lien redeem but no interest is paid on the premium amount. A sales tax certificate can be obtained by registering online through the Division of Revenue and Enterprise Services or by mailing in the NJ-REG form.

This legislation establishes requirements for publication of notice issuance of notice to the property owner bidder registration conducting the online tax lien sale as. Installments not yet due may be excluded. When a municipality has or shall have acquired title to real estate by reason of its having been struck off and sold to the municipality at a sale for delinquent taxes and assessments the governing body thereof may by resolution authorize a private sale of the.

Dates of sales vary depending on the municipality. New Jersey Sales and Use Tax Energy Return. You will find that very high premiums are paid for NJ tax liens.

Its the only state where the interest rate on the certificate amount is bid down to 0 and then premium is bid. Bidding stops to obtain the tax sale certificate. Federal Employer Id entification Number FEIN from the IRS or the owners Social Security Number if a sole proprietorship with no employees.

When prior years. The municipality has to give you back your premium of 1000000. Thats 5000 lien amount 200 4 redemption penalty 1000000 subsequent taxes 240000 24 of subs 17600.

New Jersey Tax Lien Auctions. Select A Year. The premium is kept on deposit with the municipality for up to five years.

The New Jersey Supreme Court in In re. Wages and hours subject to the New Jersey State Wage Collection Law. Workers compensation premiums 225.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Sales and Use Tax. Supreme Court addressed the New Jersey Tax Sale Law NJSA.

About Annual Tax Sales. If the interest is bid down to 1 a premium is bid up until the bidding stops to obtain the tax sale certificate. Sales and Use Tax.

In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24. List of installments not due. Nj tax sale certificate premium Monday February 14 2022 Edit.

Since the price of the properties is already fixed simply mark the properties you plan to bid on and deposit 10 percent of the total. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. The municipality will enforce the collection of those charges by offering same for sale which will cause a Tax Lien Certificate to be sold and filed against the property.

Ignoring the law may cost. Another 05 is imposed on group accident and health premiums and another 1 on all other insurance premiums. After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business.

Auction starts at 18 and interest rate can be bid down to zero then premium bidding begins. Lands listed for sale. Recording of assignments service on tax collector.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax lien certificates greater than 10000 a 6 penalty is added. Bidding down interest rate plus a premium is paid for control of the lien. New Jersey is a good state for tax lien certificate sales.

If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you. 18 or more depending on penalties. Princeton Office Park LP.

As a statutory officer of the State of New Jersey the tax collector is obligated to follow all state statutes regarding property tax collection including billing due dates interest on delinquent tax payments and tax sale procedures. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders. 2016 and prior.

The tax collector is required by state law to hold a tax sale each year for the. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Discretion of tax collector as to sale.

New Jersey is really a different animal. NJ 07102 973 733-6400 973 928-1238. The Plaintiff in a tax sale foreclosure must at least 30 days prior to filing its complaint give written notice of its intention to foreclose as well as the amount necessary to redeem.

Real Estate and Tax Law. Sales and Use Tax. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

In NJ the lenders policy expense is only a small fee of the owners title insurance premium. Here is a summary of information for tax sales in New Jersey. If the tax sale certificate is not redeemed or the.

Motor Vehicle Sales and Use Tax Exemption Report. Pay your initial deposit. Sales and Use Tax.

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube 2 Ex 99 1 2 Tm2022260d3 Ex99 1 Htm Exhibit 99 1. The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. If for any insurance company the ratio of New Jersey business to total business is greater than 125 the tax is imposed on only 125 of that companys total premiums.

A day or two before the sale at the latest you must submit a deposit of at least 10 percent of the amount you plan to bid at the tax sale. Purchasing a tax sale certificate is a form of investment. Statement in certificate of sale.

Contracts considered professional service. Resale Certificate for Non-New Jersey Sellers. NJ tax liens pay 18 on liens over 1500.

California Resale Certificate Sales Use Tax Law R Legaladvice

Sports Entertainment Collection Set Of 6 Stock Bond Certificates 1920 S 1990 S In 2021 Entertaining Cleveland Indians Baseball Certificate

Grandpa A Sons First Hero A Daughters First Love Love T Shirt T Shirt Shirts

Tax Sale Lists Now Home Facebook

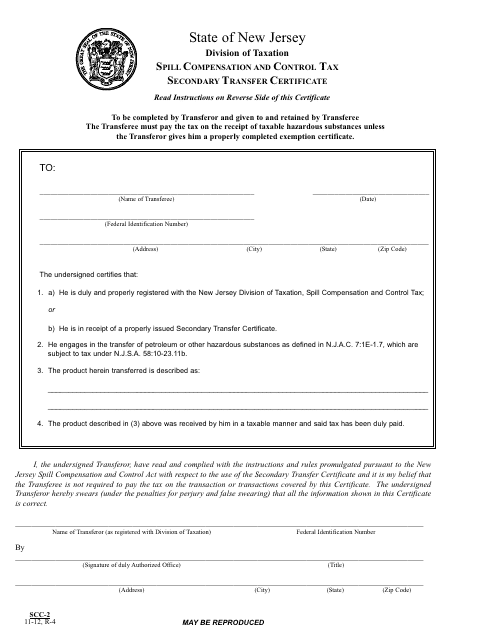

Form Scc 2 Download Fillable Pdf Or Fill Online Spill Compensation And Control Tax Secondary Transfer Certificate New Jersey Templateroller

Sports Entertainment Collection Set Of 6 Stock Bond Certificates 1920 S 1990 S In 2021 Entertaining Cleveland Indians Baseball Certificate

Form Scc 2 Download Fillable Pdf Or Fill Online Spill Compensation And Control Tax Secondary Transfer Certificate New Jersey Templateroller

Government Tax Lien Certificates And Tax Foreclosure Sale Properties

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

Donation Receipt Templates 17 Free Printable Word Excel Pdf Samples Donation Letter Template Donation Letter Receipt Template